income tax malaysia payment

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. The applicable tax rates shall be 20 for the income tax base of up to KRW 300 million and 25 for the excess.

Personal Income Tax 2016 Guide Part 7

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

. TOP will deduct 1000 from your tax refund and send it to the correct government agency. Its so easy to use. This tax rebate is why most Malaysia n fresh.

State restrictions may apply. In addition to this if the house is vacant. Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3 10th Aug 2022 80 Work Productivity Ideas Tips Activities for the Hard Workers 29th Jul 2022 Talenox Updates Q2 2022.

The Income Tax Course consists of 62 hours of instruction at the. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

Corporate Income Tax Due. You do not need to enroll to make a same-day wire payment and no PIN is needed. Such income shall be taxed separately from an investors income eg.

Just upload your form 16 claim your deductions and get your acknowledgment number online. Deduction on Interest of Home Loan. Custom Payroll Report and more.

Employment income interest on bank deposits dividends subject to annual income tax return filing capital gains and retirement income. Sage Income Tax Calculator. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Annual income tax payment is a big concern for individuals especially the salaried class who commence tax. Your checks have your routing and account number. Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C.

Calculate how tax changes will affect your pocket. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. If you have need assistance with using EFTPS contact EFTPS Tax Payment Customer Service at 800-555-4477 Businesses or 800-316-6541 Individuals.

It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. Your tax pro can prepare and file accurate back tax returns set up a payment agreement with the IRS for you and resolve any other issues related to your late returns. Heres an example.

Efiling Income Tax ReturnsITR is made easy with Clear platform. Income Tax Above 10 Lakh. The house owners are allowed to claim an income tax deduction of up to Rs2 Lakhs Rs1 50 000 if one is filing the income tax returns for Financial Year 2013-14 on the interest of the home loan if the owner and hisher family is living in that house only.

You were going to receive a 1500 federal tax refund. Tax rebate for Self. Account Type Routing Number.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. You may be required to purchase course materials which may be non-refundable. You will be granted a rebate of RM400.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Sponsor of the NR public entertainer is required to pay withholding tax of 15 before an entry permit for the NR public entertainer can be obtained from the Immigration. What you need to know about making a same day wire payment.

Malaysia Tax Guide. Remuneration or other income in respect of services performed or rendered in Malaysia by a NR public entertainer is subject to withholding tax of 15 on the gross payment. But you are delinquent on a student loan and have 1000 outstanding.

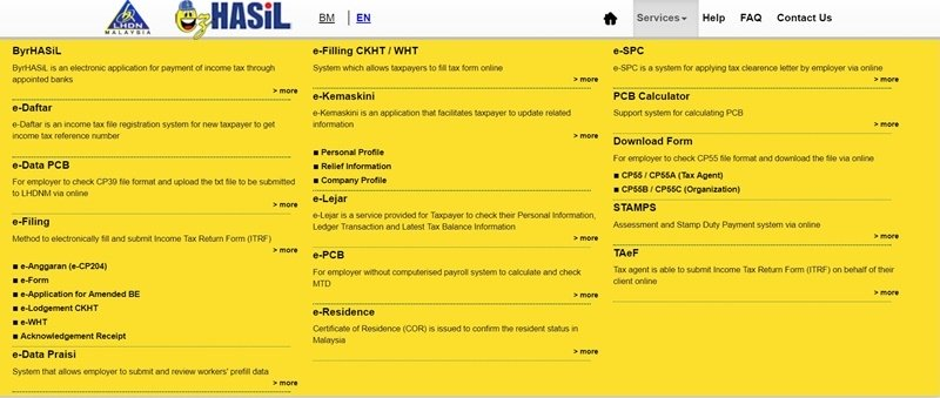

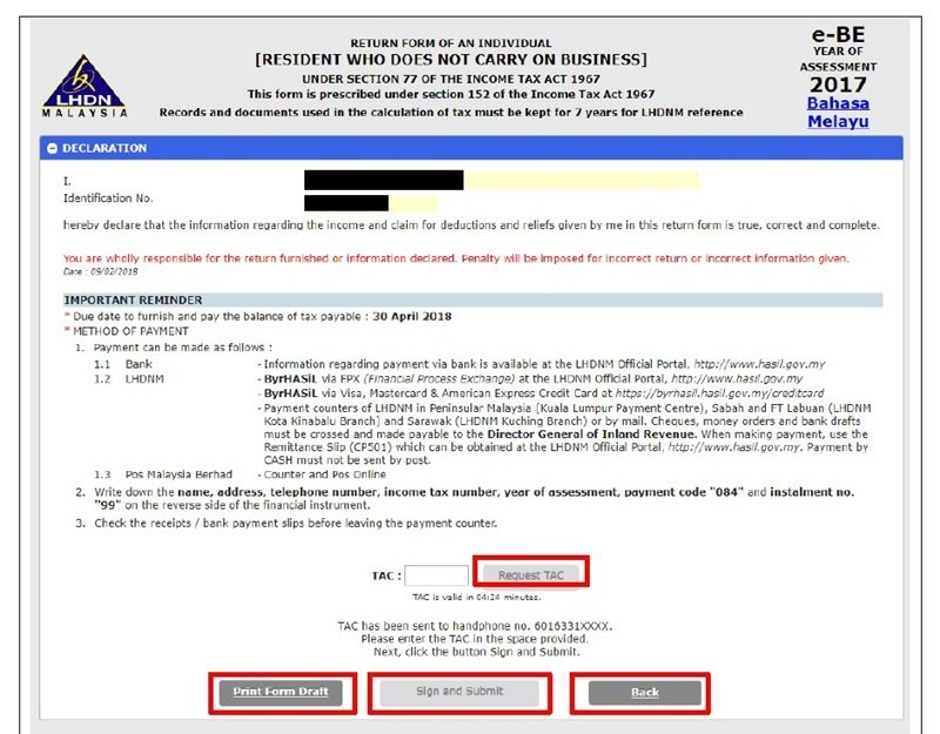

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Guam Corporate Tax Rate 2022 Data 2023 Forecast 2015 2021 Historical Chart

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Guide For Expats In Malaysia Expatgo

Should Advertisers Pay Withholding Tax On Google Facebook Advertising In Malaysia Ecinsider

Malaysiabudget2022 Explore Facebook

Journal Entry For Income Tax Refund How To Record In Your Books

Pdf Determinants Of Online Tax Payment System In Malaysia

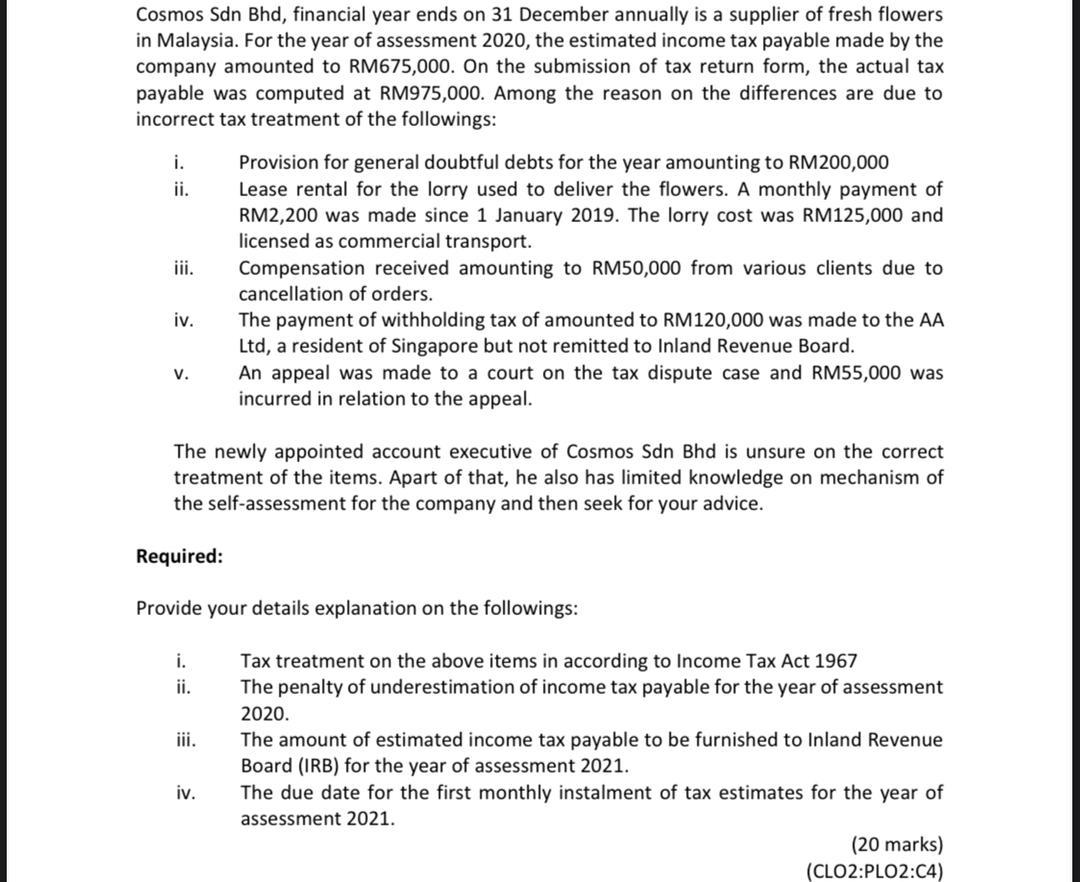

Solved Cosmos Sdn Bhd Financial Year Ends On 31 December Chegg Com

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Individual Income Tax In Malaysia For Expats Gpa

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

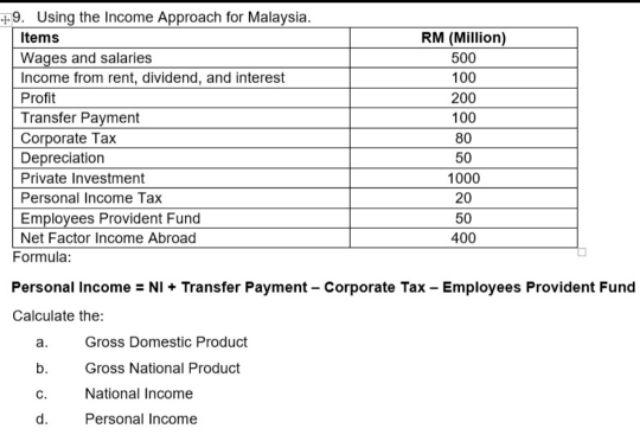

Solved 4 Usina The Income Annroach For Malavsia Personal Chegg Com

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

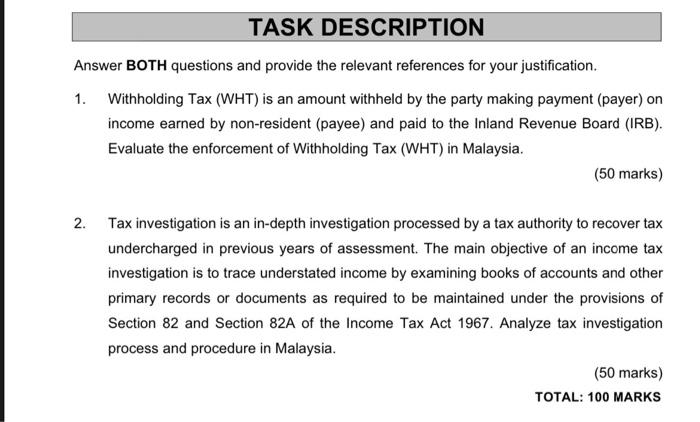

Solved Task Description Answer Both Questions And Provide Chegg Com

Comments

Post a Comment